Unsecured Institutional Lending

Powered by DeFi

Innflux is the world's first composable credit layer. Supply, borrow, and unlock institutional liquidity.

Automated Risk Engine

One unified risk score to credit risk businesses utilising all available on-chain and off-chain indicators.

Composable Collateral

Deposit USDT or Staked AMM LP positions as collateral. RWA yield without unwinding AMM positions.

Permissionless Lending

Unlocking retail Defi liquidity for TradeFi credit lines.

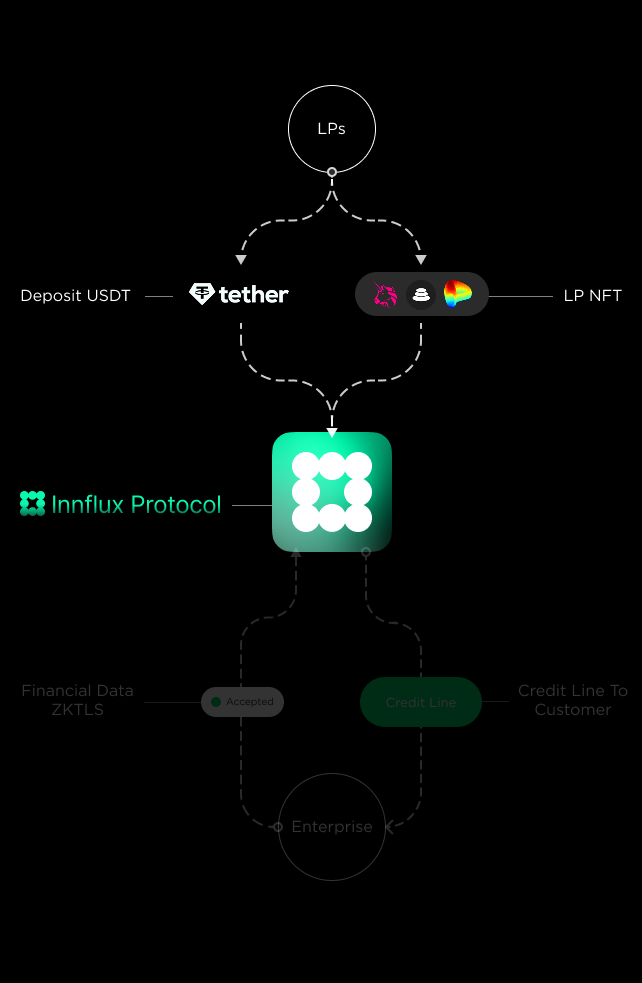

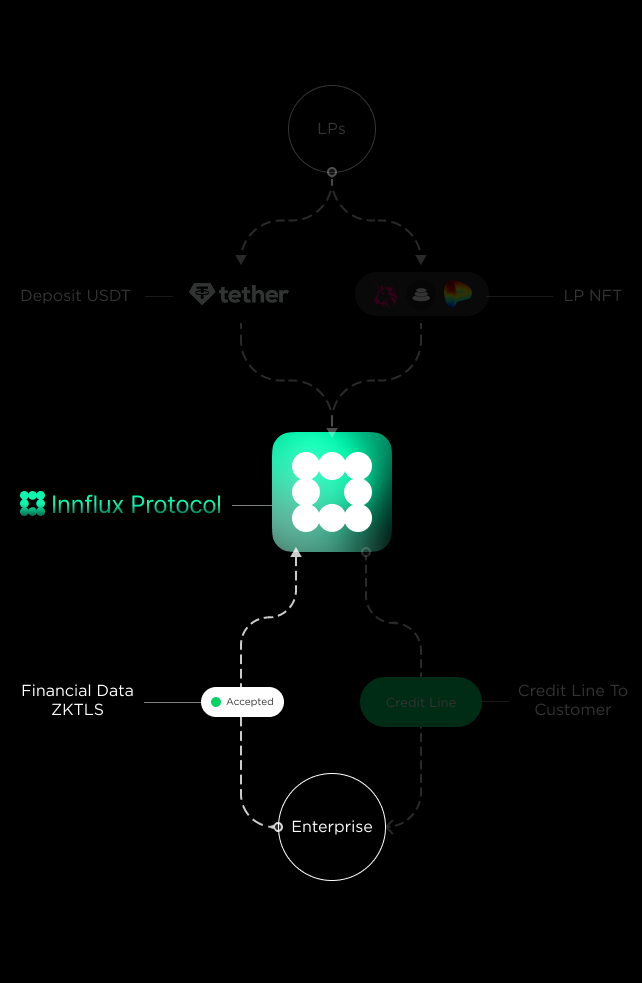

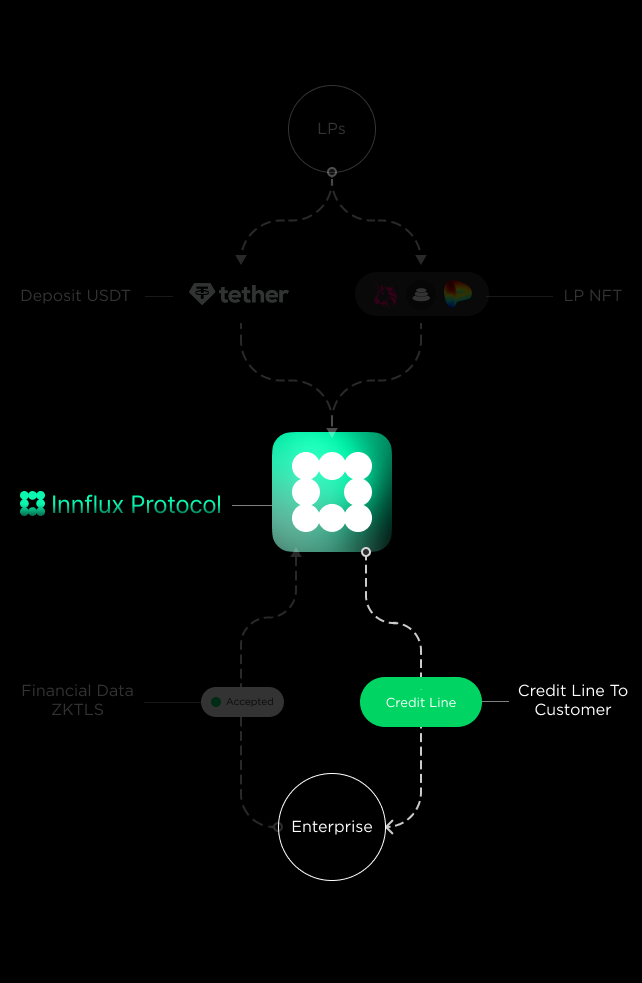

How it Works

Deposit USDT or LP NFT

Earn yield by depositing USDT or LP NFT into our protocol. Your deposits are secured by smart contracts and can be withdrawn anytime. Each deposit is carefully managed with real-time risk assessment and automated yield optimization.

Finance Invoice data ZKTLS

Through our Financial Data ZKTLS system and credit line processing, enterprises can access credit lines while maintaining privacy and security.

Credit Line to Customer

Qualified customers receive instant credit lines based on their invoice data and risk assessment. Our protocol automatically manages credit distribution, repayment tracking, and yield distribution to depositors.

What We're Building

Current DeFi solutions cover mostly restrictive collateralised capital limited to other crypto-assets.

Innflux is bridging this gap to turn institutional real-time trade flows into credit lines.

Innflux is the first credit layer to recycle idle DEX liquidity into risk adjusted trade-finance lines for emerging-market SMEs—combining real-time on-chain risk scoring with off-chain invoice, bank and bureau data.

Innflux is solving the multi-trillion dollar institutional credit gap in frontier markets.

Stablecoins have already solved a medium of exchange problem for cross-border settlements.

Yet, credit access to enterprises is still gate-kept via private lenders.

Traditional banks price cross-border credit risk conservatively in emerging markets sticking to outdated frameworks that omit on-chain activity and stable coin usage.

This reliance on outdated risk frameworks renders them unable to provide appropriate credit to growing enterprises.

Borrowing

Uncollateralised Institutional Credit in minutes.

-

Credit lines$250k–$10M with dynamic quotes.

-

Hybrid scoringon-chain cash-flow + off-chain bureaus + custom weights.

Powered by FluxScore. -

No crypto collateralTrade history backed lines.

-

Built in fiat rampsbridge secured credit lines to fiat instantly.

-

Fully CompliantInnflux monitors all lender wallets for AML, FATCA compliance checks.

Lending

Lend Anything. Earn Real-World USDC Yield.

-

Plug in any assetstablecoins, out-of-range Uni V3 LP ERC 721's.

-

DeFi composabilityGet composable tokens in exchange for liquidity and wrap your receipt token to farm, leverage, or restake elsewhere.

-

Instant exitswithdraw any time with zero lock-ups.

-

Transparent risksee borrower score and payment streams onchain.

-

Best risk adjusted returnsInsurance layer buys bad debt in case of any delays.

Secure.

Onchain.

Lenders enjoy defi's composability with treasury backed risk covers. Enjoy best in class yields on stablecoins. Withdraw anytime.

What is Innflux?

Are there withdrawal limits?

How are funds protected?

How do you verify invoice authenticity?

What about regulatory?

Unlock

Early Access

Be part of the first wave to experience payment finance on-chain. Deploy stablecoins into short-term trade deals with real-world backing and risk protection.